“One of the largest and most highly regarded bankruptcy practices in the nation.”

– Law360

Since 1983, Pachulski Stang Ziehl & Jones LLP has maintained a commitment to excellence that has earned it recognition as one of the nation's top insolvency practices.

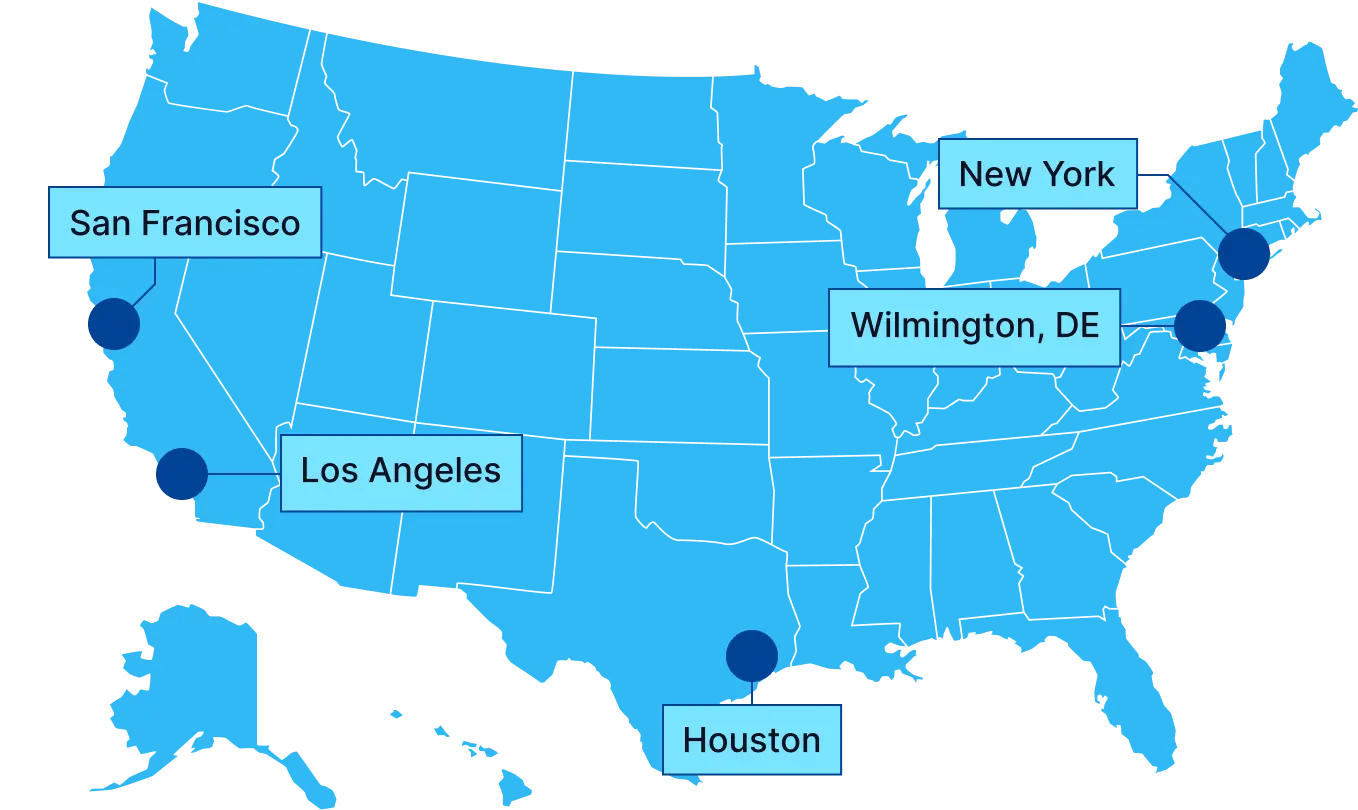

We have become the largest law firm in the country devoted primarily to corporate restructurings, with offices in Los Angeles, New York, Delaware, Houston, and San Francisco. But our philosophy has not changed: The strength of our team of talented lawyers is expertise and experience, not numbers. As a result, we believe we offer a unique combination of top-quality representation and small-firm economics and commitment.

We have depth and expertise in four distinct, but closely related areas:

Our goal is to provide exceptional and effective representation to a wide variety of clients, large public corporations and smaller businesses, debtors, creditors' committees and trustees, across many industries. We have a proven track record of success, and understand full well that we are judged by the results we achieve for our clients.

Strategically Located

The firm’s strategic office locations allow us to handle the most significant bankruptcy matters throughout the United States and abroad, and file these cases in the jurisdiction that best meets a client’s objectives.

View Our Results

Clients hire lawyers, not law firms. We do not overlawyer matters, and the attorneys that our clients hire stay actively involved.

Our firm is not leveraged on large numbers of associates. The result, we believe, is cost-effective representation and greater client satisfaction.

Although our primary objective is to seek business solutions to our clients’ problems, we are known as effective litigators as well as skilled negotiators. The credible threat of litigation allows us to maximize results in negotiations. If negotiations break down, we are prepared to aggressively litigate our clients’ positions.

The firm’s strategic office locations allow us to handle the most significant bankruptcy matters throughout the United States and abroad, and file these cases in the jurisdiction that best meets a client’s objectives.

Pachulski Stang Ziehl & Jones Named a 2025 “Delaware Regional Powerhouse” by Law360

Law360September 11, 2025

James W. Walker Recognized Among Lawdragon's 2026 “500 Leading Litigators in America"

LawdragonSeptember 5, 2025

PSZJ Continues to Rank Among Leading Law Firms in Prestigious Chambers USA Guide

Chambers USAJune 5, 2025

Shirley Cho Selected to Los Angeles Daily Journal’s 2025 “Top Women Lawyers” List

Los Angeles Daily JournalMay 28, 2025

Laura Davis Jones Named Among ABF Journal’s Inaugural “Legends and Leaders: Trailblazers”

ABF JournalMay 20, 2025

Shirley Cho Selected to Los Angeles Business Journal’s 2025 “Top 100 Lawyers” List

Los Angeles Business JournalApril 23, 2025

PSZJ Continues to Rank Among Leading Law Firms in Prestigious Chambers Global Guide

Chambers GlobalFebruary 12, 2025

PSZJ Wins Four M&A Advisor Turnaround Awards

M&A AdvisorJanuary 16, 2025

Pachulski Stang Ziehl & Jones and its attorneys believe that social responsibility is a part of the practice of law. Many of our attorneys sit on charitable boards, and the firm donates a percentage of annual revenue to a diverse collection of worthy nonprofits.

The Pachulski Stang Ziehl & Jones Charitable Fund

The Pachulski Stang Ziehl & Jones Charitable Fund regularly contributes to the following charities:

Charitable Boards

Our attorneys sit on legal, academic, and other charitable boards such as:

- U.S. Supreme Court Historical Society

- CARE Los Angeles

- Harper for Kids

- Beverly Hills Bar Foundation

- South Asian Bar Association

- Pennsylvania Academy of the Fine Arts

- American Youth Soccer Organization (AYSO)

- Boalt Hall Alumni Association

- Children’s Relief Association

- University of California, Hastings College of the Law, Foundation

- Friends of Children’s Center for the Visually Impaired

- Asian Pacific American Legal Center

- Philadelphia Art Alliance

- Prefund.org

- Mendelssohn Club of Philadelphia

- International Insolvency Institute

- Settlement Music School

- American College of Bankruptcy Foundation

- Loyola Law School Advocacy Institute

- International Women’s Insolvency & Restructuring Confederation (IWIRC)

National Presence, Global Reach

Our specialized bankruptcy attorneys are strategically positioned across the country, offering top-tier legal expertise with international reach. Find the right partner for your complex restructuring and insolvency challenges.

Meet Our Attorneys